interest tax shield explained

It is also notable that the interest tax shield value is. The payment of interest expense reduces the taxable income and.

Interest Tax Shields Meaning Importance And More

------------------------------------- tax shield is the saving in taxable income for individualscorporations by cutting the expansible allowance such as depreciation mortgage interests hospital.

. This reduces the amount of income that is. Such allowable deductions include mortgage. Interest tax shields are a method of reducing taxable income by deducting the interest payments on debt from taxable income.

The interest tax shield is positive when the Earnings Before Interest and Taxes EBIT is greater than the interest payment. The tax shield can be specifically represented as per tax-deductible expenses. This interest payment therefore acts as a shield to the tax obligation.

For example a mortgage provides an interest tax shield for a. A tax shield refers to an allowable deduction on taxable income which leads to a reduction in taxes owed to the government. Stated another way its the deliberate use of taxable expenses to offset taxable income.

The Interest Tax Shield refers to the tax savings resulting from the tax-deductibility of the interest expense on debt borrowings. Interest expenses via loans. A tax shield is an income tax deduction that reduces taxable income.

Companies pay taxes on the income they generate. For example a mortgage provides an interest tax shield for a. Interest Tax Shield A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income.

As is hopefully clear by this stage the interest tax shield is. An interest tax shield refers to the tax savings made by a company as a direct result of its debt interest payments. Interest Tax Shield Example A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate.

The calculation of interest tax shield can be obtained by multiplying average debt cost of debt Cost Of Debt Cost. A Tax Shield is an allowable deduction from taxable income that results in a reduction of taxes owedClick here to learn more about this topic. A tax shield is a reduction in taxable income by taking allowable deductions.

Whats the Difference Between a Tax Shield and a Tax Deduction. For example if you are in the 25 tax bracket a 1000. Examples of tax shields include deductions for charitable contributions mortgage deductions.

An interest tax shield is a term used to describe a tax break that involves deducting the interest paid on some portion of the income that is subject to taxation. CF CI CO CI CO D t. For example Company ABC has a 10 loan of.

Where CF is the after-tax operating cash flow CI is the pre-tax cash inflow CO is pre-tax cash outflow t is the tax rate and D is the depreciation. We also call this Interest tax shield. Interest Tax Shield As the name suggests and discussed earlier the interest tax shield approach refers to the deduction claimed in the tax burden due to the interest expenses.

This companys tax savings is equivalent to the interest. Interest payments on loans are deductible meaning that they reduce the taxable income. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deductions such as mortgage interest medical expenses.

The value of a. Interest Tax Shield A reduction in tax liability coming from the ability to deduct interest payments from ones taxable income. The tax savings for the company is the amount of interest multiplied by the tax rate.

A tax shield refers to deductions taxpayers can take to lower their taxable income. A tax shield is a reduction in taxable income for an individual or corporation achieved through claiming allowable deduction as mortgage interest medical expenditure charitable donation. Interest tax shields refer to the reduction in the tax liability due to the interest expenses.

Tax Shield Formula How To Calculate Tax Shield With Example

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shields Financial Expenses And Losses Carried Forward

The Interest Tax Shield Explained On One Page Marco Houweling

Tax Shield Meaning Importance Calculation And More

Interest Tax Shield Formula And Excel Calculator

Tax Shield Formula Step By Step Calculation With Examples

Resolution Of Tax Shield On Interest Expense In Wacc Edward Bodmer Project And Corporate Finance

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula How To Calculate Tax Shield With Example

Tax Shield Formula How To Calculate Tax Shield With Example

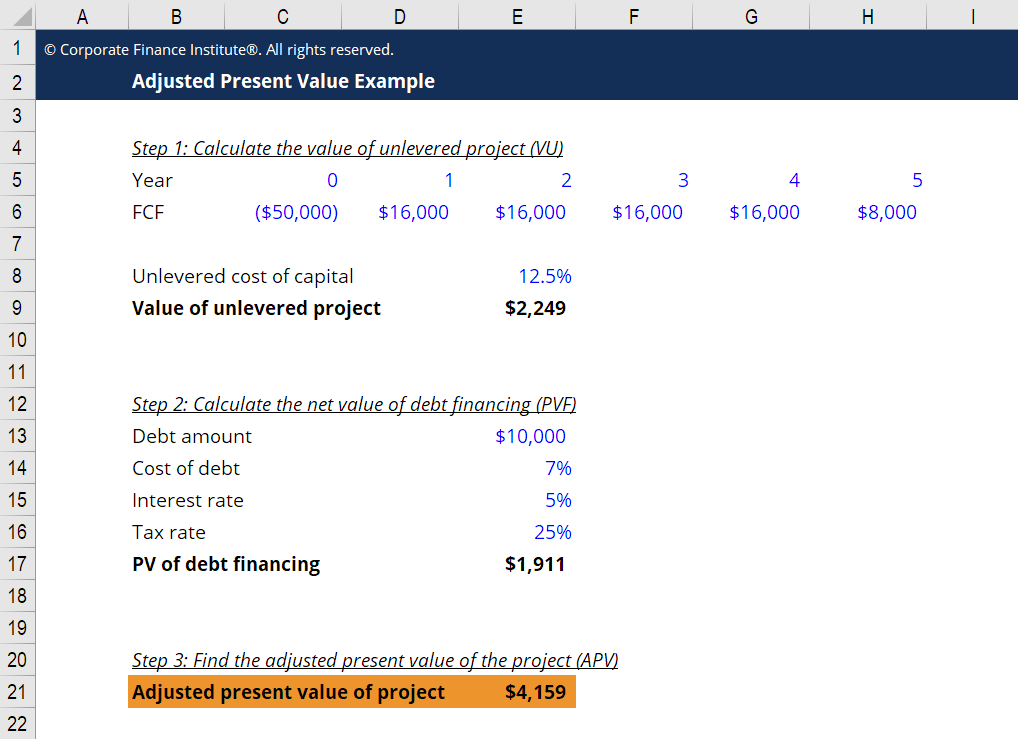

Adjusted Present Value Apv Definition Explanation Examples

What Is A Tax Shield Depreciation Tax Shield Youtube

Tax Shield Formula Step By Step Calculation With Examples

Tax Shield Formula Step By Step Calculation With Examples